SVB Bank Collapse

Is American Banking Safe?

April 11, 2023

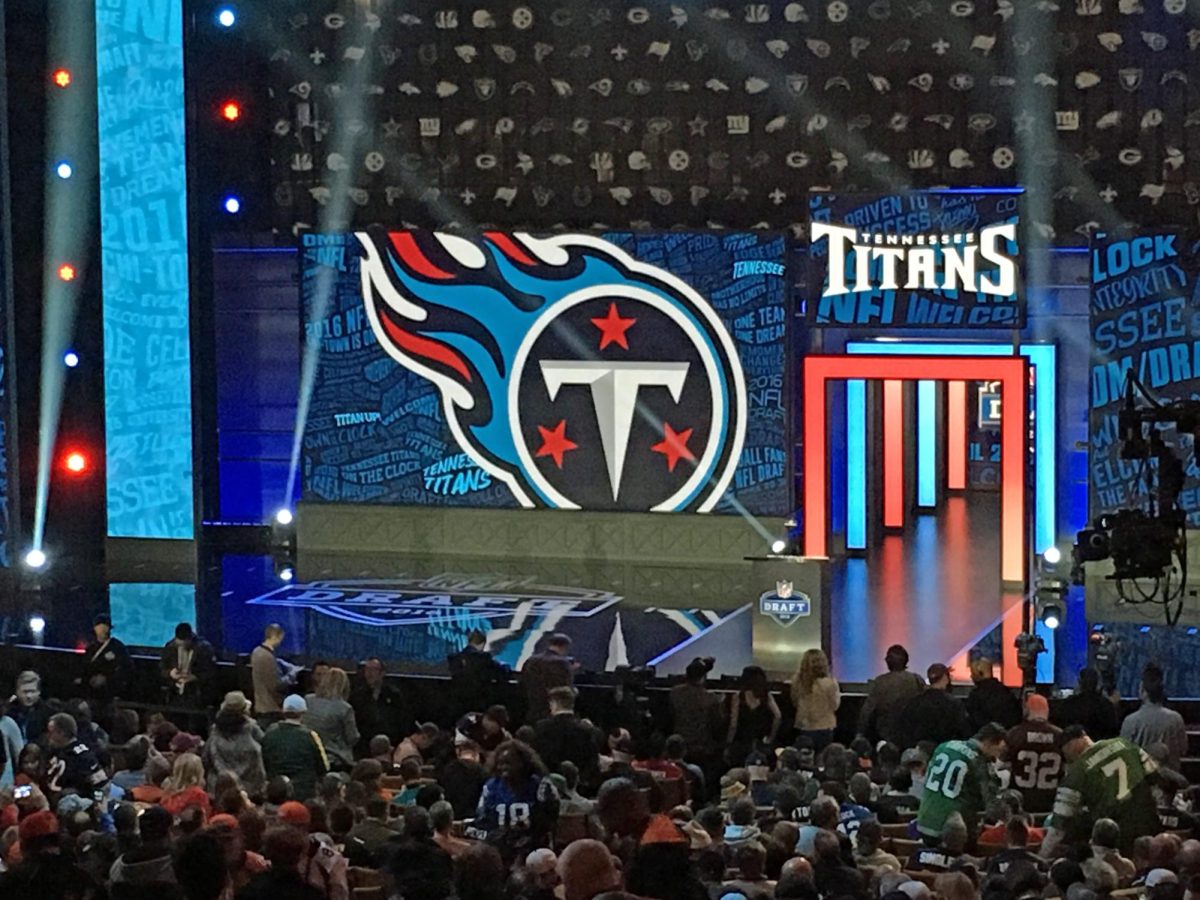

Have you ever seen pictures of the infamous bank runs that instigated the Great Depression? Well, the image attached to this article is one of those famous pictures, and this same exact phenomenon happened just a few weeks ago at a regional bank in Southern California called Silicon Valley Bank. Now, while you may not have heard about SVB before it collapsed, the bank actually served a very important role in our economy and its failure may have a ripple-effect.

Because of its location in Silicon Valley, California, the area with the most tech and start-up companies in the US, it served an important role in extending loans to these new tech start-ups. As a result, they made a lot of money because many of their loans were paid back, and because they funded start-up companies with lots of risk, they could charge high interest rates which means they could make even more money from these loans. However, due to this high risk, a lot of companies they gave loans to defaulted on their loans as they were unable to pay it back because their idea did not succeed. So, to mitigate these losses, SVB’s management decided to invest in US Treasury Bonds. While bonds are usually very secure and will almost always return a net positive, the company invested at a time when interest rates were very low (around the peak of COVID).

However, when the Federal Reserve decided to raise interest rates to combat growing inflation, it meant that the long-term bonds that SVB bought deteriorated in value. But that wasn’t a problem at the moment, because as long as they waited out the entire period of the 10 and 30 year bonds before selling them they would still make money. And here is where the bank run comes into play. Because of the increasing interest rates and economic instability, many tech companies pulled their money out of SVB, triggering a bank run. However, SVB had people’s money invested in long term bonds. Therefore, with many people asking for their money back, SVB was forced to sell their bonds at a loss, so the “riskless” bonds they bought actually lost them money. As a result, they weren’t able to pay back the money that people were asking for and the bank collapsed.

You now might be wondering if we’re actually going to enter another Great Depression. The short answer is “no”. The Fed has already taken care of the liquidation of the company and who is buying it out. Furthermore, President Biden also promised to repay, in full, every single one of SVB’s depositors. This might seem a bit over-reactionary as companies like Roku had hundreds of millions in the bank, however, this is just a tactic to calm the public and make sure people don’t panic and run any other smaller, regional banks into collapse. The largest effect that the SVB collapse will have is to slow down interest rate hikes temporarily, which may postpone the drops in inflation we all desire. So, while the SVB bank collapse is a scary prospect, ultimately it should be an isolated occurrence that happened because of mismanagement rather than a collapsing economy.